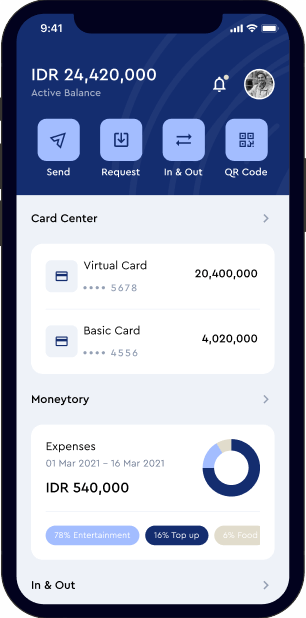

Track your daily finances automatically. Manage your money in a friendly & flexible way, making it easy to spend guilt-free.

Allows users to record and categorize daily transactions such as income, expenses, bills, and savings.

Provides visual insights like graphs or pie charts to show how much is spent versus the budgeted amount.

For users interested in investing, finance apps often provide tools to track stocks, bonds or mutual funds.

This tool integrate with tax software to help users prepare for tax season, deduct expenses, and file returns.

Tracks upcoming bills, sets reminders for due dates, and enables easy payments via integration with online banking

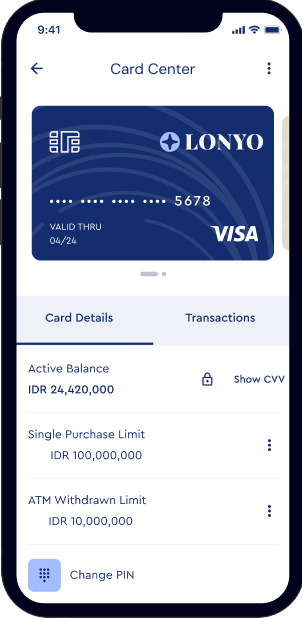

Provides bank-level encryption to ensure user data and financial information remain safe, MFA and biometric logins.

With this tool, you can say goodbye to overspending, stay on track with your savings goals, and say goodbye to financial worries. Get ready for a clearer view of your finances like never before!

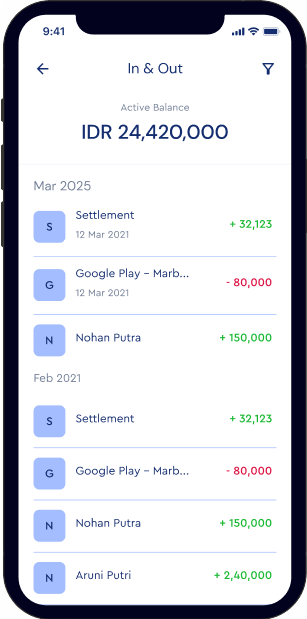

Automatically and syncs with bank accounts and credit cards to provide instant updates on spending, helping users stay aware of their all daily transactions.

Provides clear, consolidated views of income, expenses, savings, and investments, giving users a better understanding of their financial health.

Automates bill payments, savings contributions, financial reporting, reducing manual effort and the anxiety associated with missed payments.

This feature ensures you can easily stay on top of your finances by consolidating all updates into a single dashboard.

It's a cloud-based accounting tool ideal for individuals & businesses to easily manage finances, invoices & payroll. Unlock the 3-step path to enhanced financial control.

Link your bank, credit card or investment accounts to automatically track transactions and get a complete financial overview

Define your spending limits and savings goals for categories like groceries, bills or future investments to stay on track.

Check your financial dashboard for regular updates and set up automatic payments or savings to simplify management.

“This app has completely transformed how I manage my money. I can track all my expenses and set up savings goals easily. It’s like having a personal finance manager in my pocket!”

“I can see all my spending in one place and set limits. It’s really helped me avoid overspending and manage my bills on time.”

"This app transformed my budgeting! I now have a clear view of my expenses and savings goals."

“This app has completely transformed how I manage my money. I can track all my expenses and set up savings goals easily. It’s like having a personal finance manager in my pocket!”

“I can see all my spending in one place and set limits. It’s really helped me avoid overspending and manage my bills on time.”

"This app transformed my budgeting! I now have a clear view of my expenses and savings goals."

“This app has completely transformed how I manage my money. I can track all my expenses and set up savings goals easily. It’s like having a personal finance manager in my pocket!”

“I can see all my spending in one place and set limits. It’s really helped me avoid overspending and manage my bills on time.”

"This app transformed my budgeting! I now have a clear view of my expenses and savings goals."

“This app has completely transformed how I manage my money. I can track all my expenses and set up savings goals easily. It’s like having a personal finance manager in my pocket!”

“I can see all my spending in one place and set limits. It’s really helped me avoid overspending and manage my bills on time.”

"Having all my accounts in one place gives me complete overspending accounts control over my money. Highly recommend!"

“I use it for my business accounting, expenses, and tax prep are all so easier. It saves me time and stress.”

"Having all my accounts in one place gives me complete overspending accounts control over my money. Highly recommend!"

“I use it for my business accounting, expenses, and tax prep are all so easier. It saves me time and stress.”

"Having all my accounts in one place gives me complete overspending accounts control over my money. Highly recommend!"

“I use it for my business accounting, expenses, and tax prep are all so easier. It saves me time and stress.”

"Having all my accounts in one place gives me complete overspending accounts control over my money. Highly recommend!"

“I use it for my business accounting, expenses, and tax prep are all so easier. It saves me time and stress.”

"Having all my accounts in one place gives me complete overspending accounts control over my money. Highly recommend!"

“I use it for my business accounting, expenses, and tax prep are all so easier. It saves me time and stress.”

“With this app, I’ve been able to stick to my budget and even save for a vacation. The goal-setting feature is super motivating! The budget alerts are a game changer!”

"Having all my accounts in one place gives me complete control over my money. So user-friendly and helpful! Highly recommend!"

"I love how easy it is to track my spending. The real-time updates keep me on top of my finances."

“With this app, I’ve been able to stick to my budget and even save for a vacation. The goal-setting feature is super motivating! The budget alerts are a game changer!”

"Having all my accounts in one place gives me complete control over my money. So user-friendly and helpful! Highly recommend!"

"I love how easy it is to track my spending. The real-time updates keep me on top of my finances."

“With this app, I’ve been able to stick to my budget and even save for a vacation. The goal-setting feature is super motivating! The budget alerts are a game changer!”

"Having all my accounts in one place gives me complete control over my money. So user-friendly and helpful! Highly recommend!"

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.

Yes, you can connect multiple accounts, including savings, checking, and credit cards, for real-time tracking of all your finances in one place.

This app allows you to set personalized budget limits for different categories and sends alerts or notifications when you’re close to exceeding them.

Yes you can, many finance apps allow you to monitor investments such as stocks, bonds, and mutual funds, providing insights into portfolio performance.

Automates bill payments, savings contributions, financial reporting, reducing manual effort and the anxiety associated with missed payments.