Leading brands around the world have saved millions of hours with it.

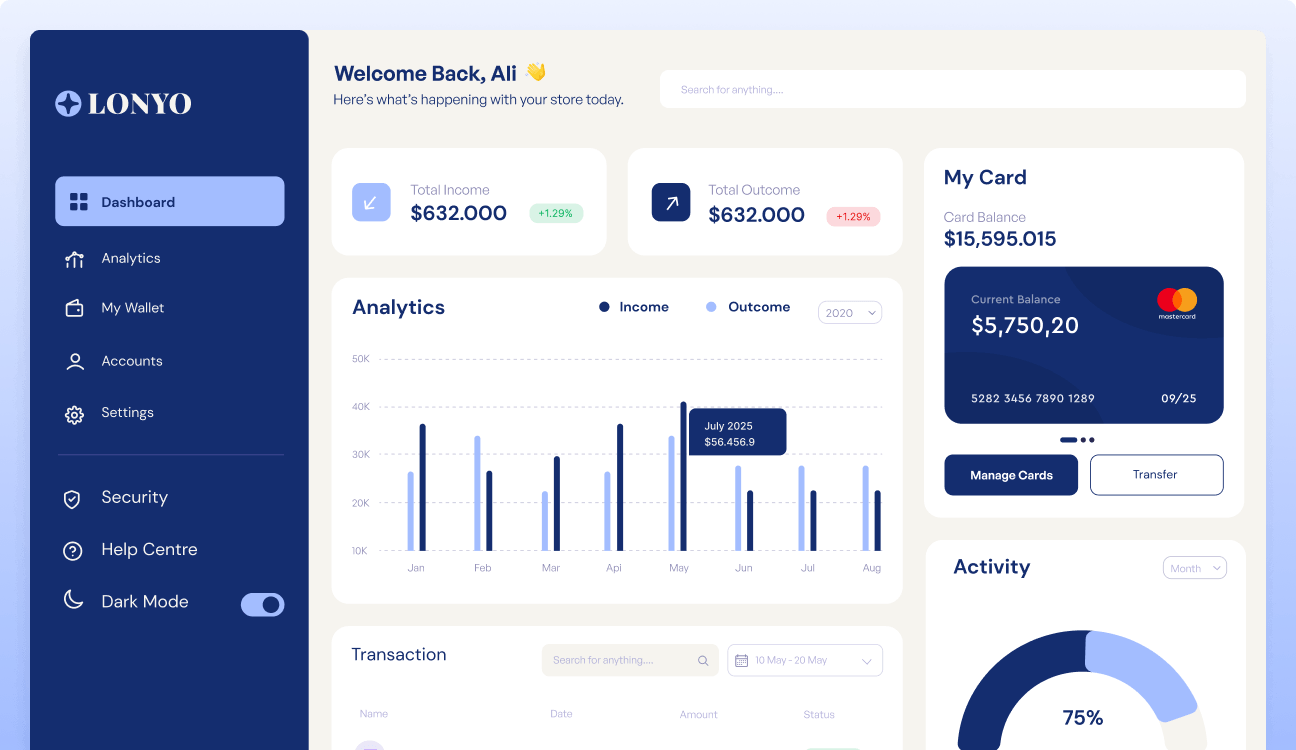

With this tool, you can say goodbye to overspending, stay on track with your savings goals, and say goodbye to financial worries. Get ready for a clearer view of your finances like never before!

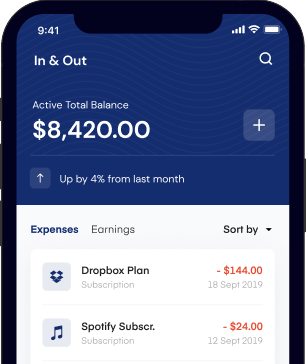

Automatically and syncs with bank accounts and credit cards to provide instant updates on spending, helping users stay aware of their all daily transactions.

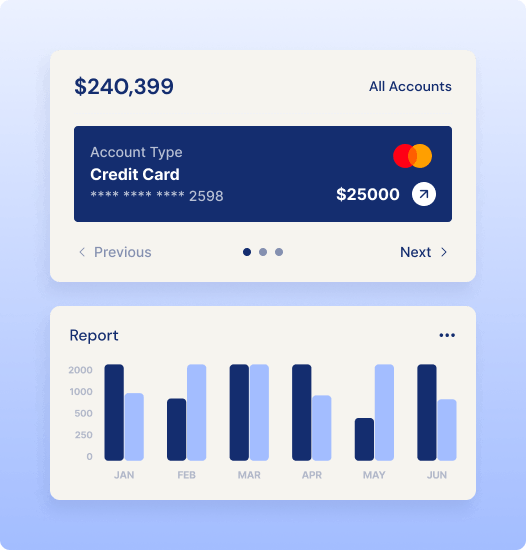

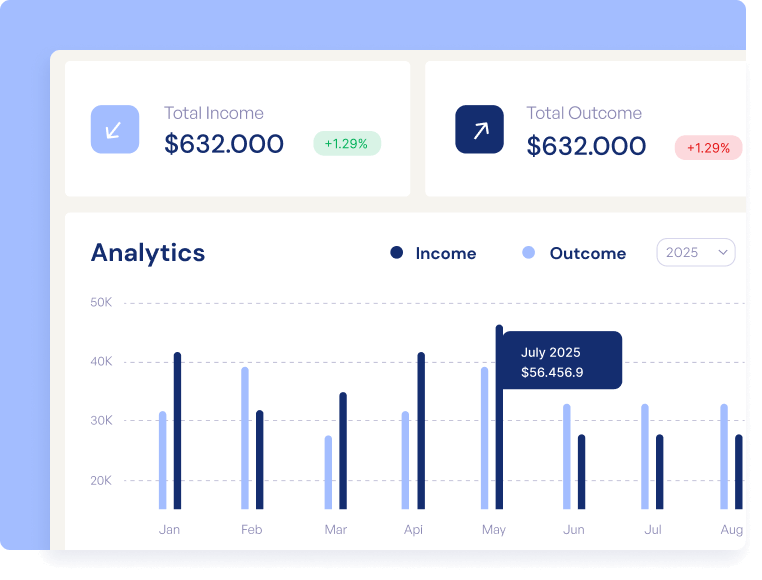

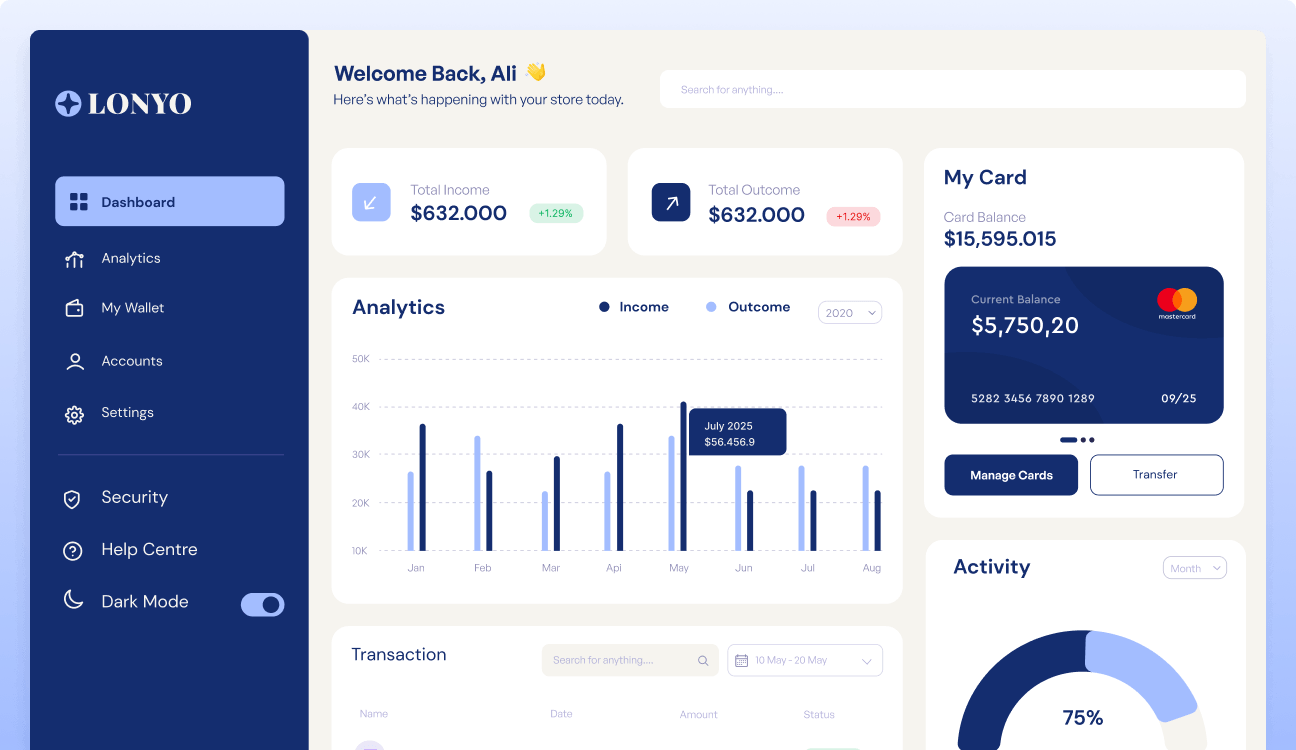

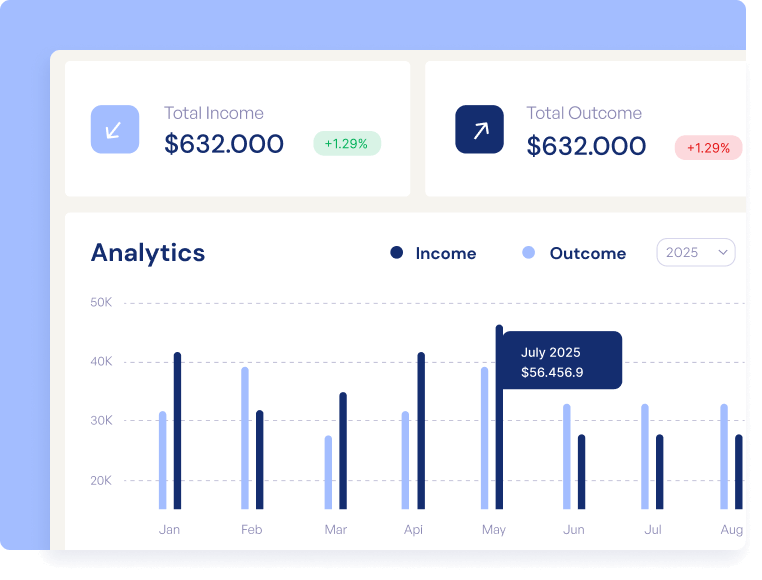

Provides clear, consolidated views of income, expenses, savings, and investments, giving users a better understanding of their financial health.

Automates bill payments, savings contributions, financial reporting, reducing manual effort and the anxiety associated with missed payments.

Tax preparation, profit & loss statements, balance sheets, and customized reports.

Integration with payment processors like PayPal, Venmo, or business accounting platforms.

It connects to all types of cards and spending modes to become smarter over time.

Tax preparation, profit & loss statements, balance sheets, and customized reports.

This feature ensures you can easily stay on top of your finances by consolidating all updates into a single dashboard.

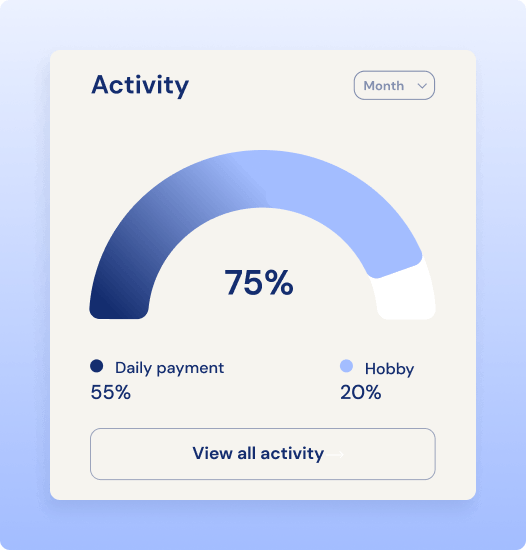

Users can set budget limits for different categories. This tool provides visual insights such as graphs to show how much has been spent.

Tracks upcoming bills, sets reminders for due dates, and enables easy payments via integration with online banking.

For users interested in investing, finance apps often provide tools to track stocks, bonds, mutual funds, or cryptocurrency.

/per user/mo

What’s included:

/per user/mo

What’s included:

/per user/mo

What’s included:

Our finance apps and software are powerful tools for managing personal or business finances, helping users stay organized, track financial health, make and informed decisions.