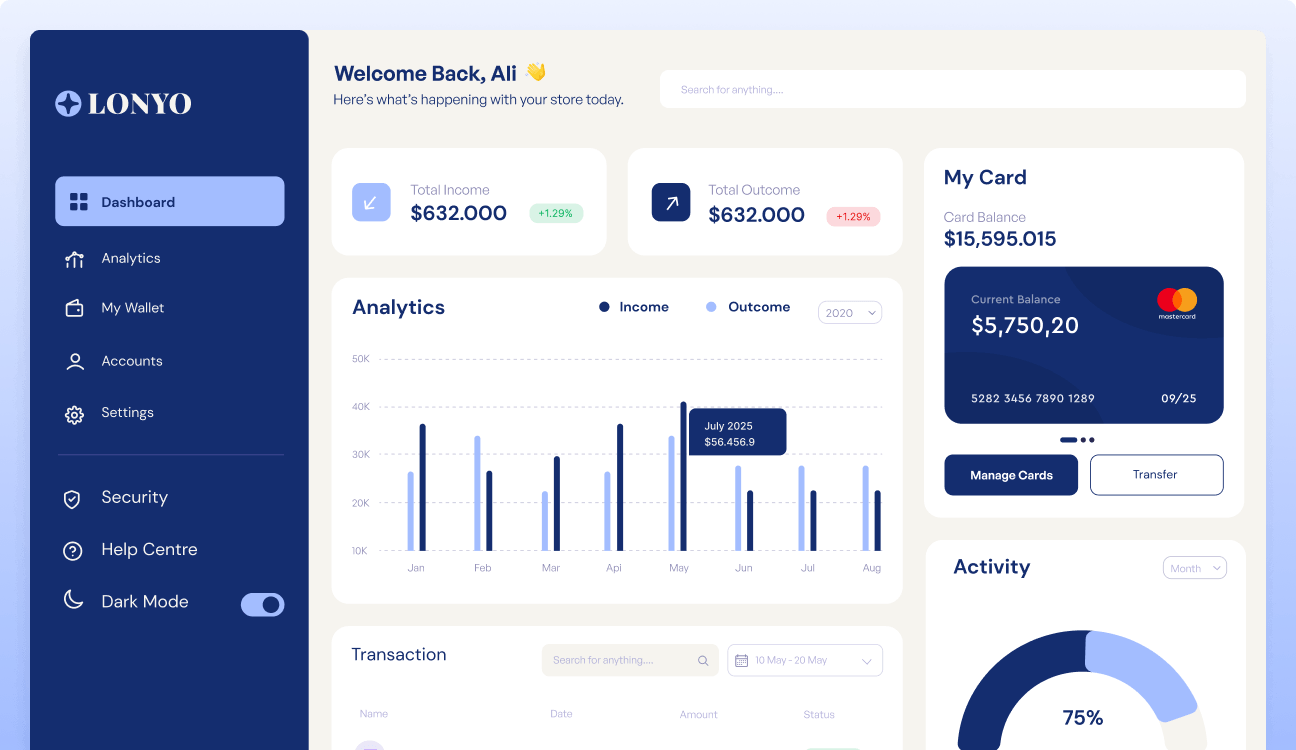

Track your daily finances automatically. Manage your money in a friendly & flexible way, making it easy to spend guilt-free.

Allows users to record and categorize daily transactions such as income, expenses, bills, and savings.

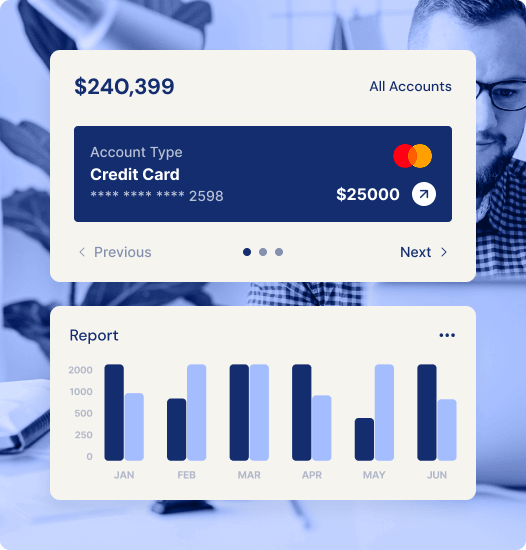

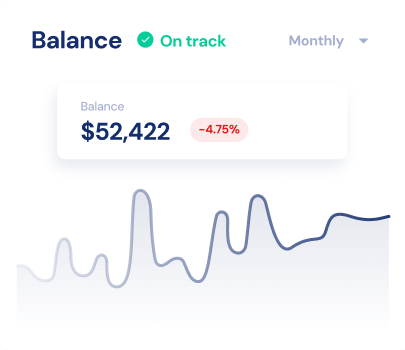

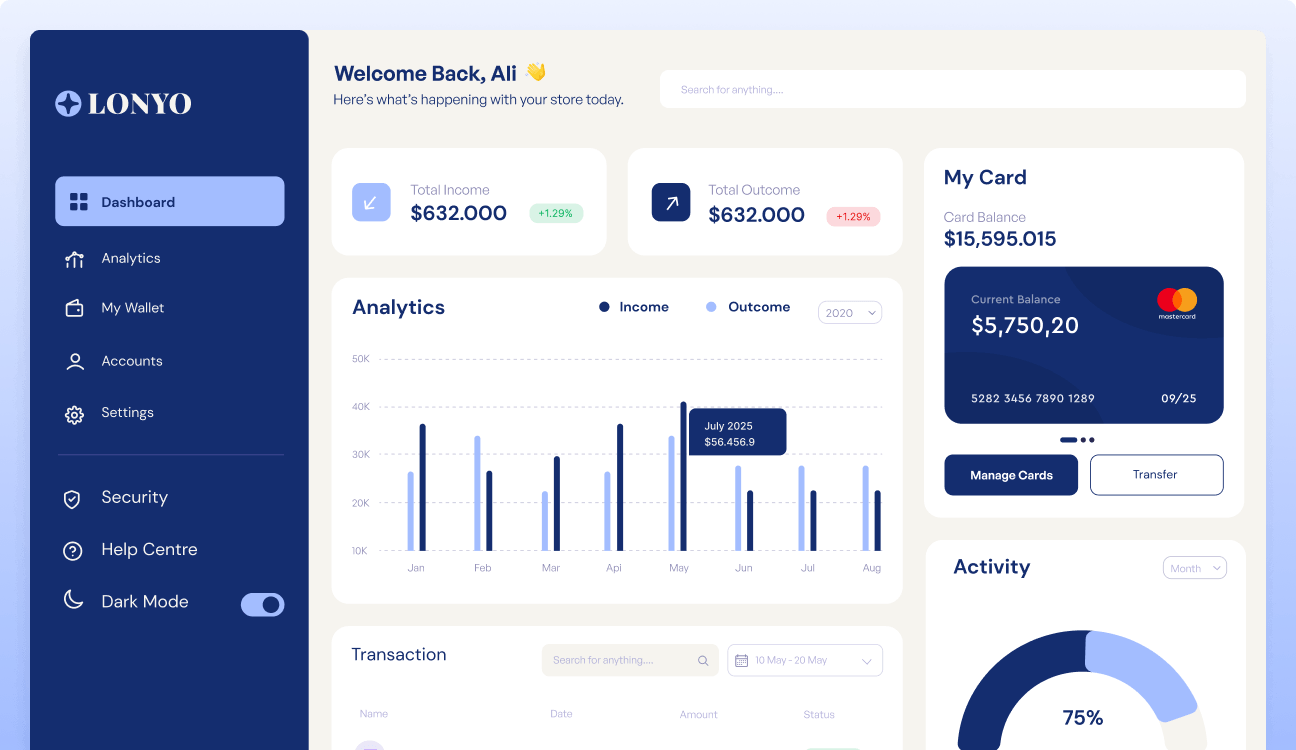

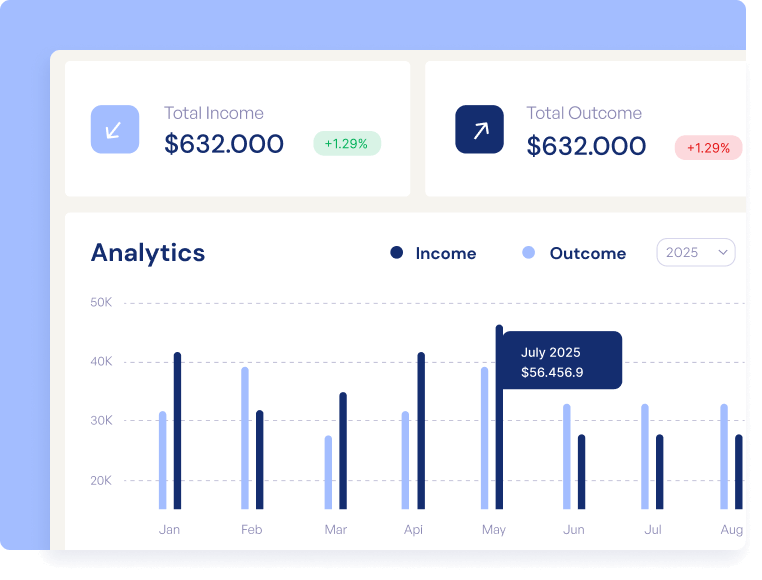

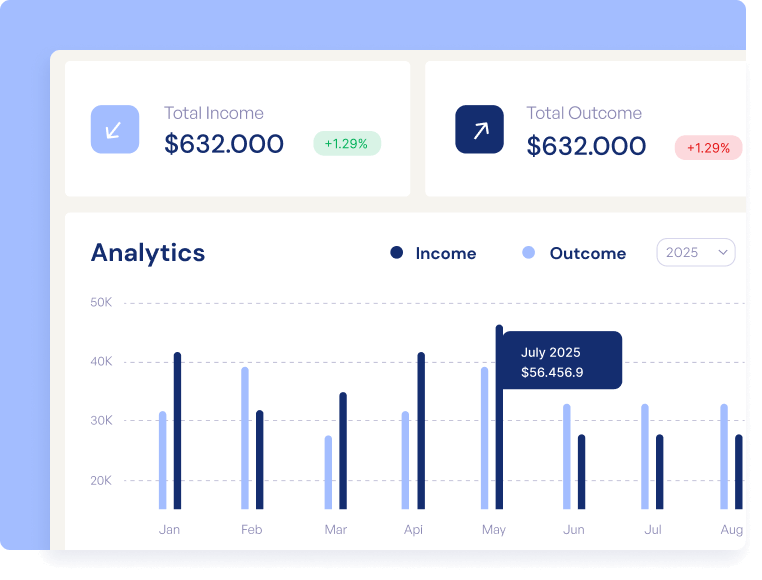

Provides visual insights like graphs or pie charts to show how much is spent versus the budgeted amount.

For users interested in investing, finance apps often provide tools to track stocks, bonds or mutual funds.

This tool integrate with tax software to help users prepare for tax season, deduct expenses, and file returns.

Tracks upcoming bills, sets reminders for due dates, and enables easy payments via integration with online banking

Provides bank-level encryption to ensure user data and financial information remain safe, MFA and biometric logins.

With this app, the process of planning, tracking, and controlling cash flow from your business is simplified.

This includes forecasting future cash needs and ensuring that sufficient funds are available to meet these needs, as well as managing excess cash in a way that maximizes its value.

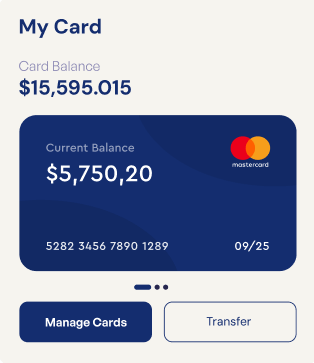

Experience the convenience of transferring your money quickly and securely with our advanced financial services.

Comprehensive payment card solutions tailored for every aspect of your business requirements.

It is essential to ensure it can seamlessly integrate with all your financial accounts. This includes synchronization with your bank accounts, credit cards, and investment accounts.

The interface is intuitive, and I love how it automatically syncs with my bank accounts. I no longer have to worry about manual tracking. Highly recommend!

With this app, I’ve been able to stick to my budget and even save for a vacation. The goal-setting feature is super motivating! The budget alerts are a game changer!

If you have any questions, rest assured that we are here to give you the answers you want! Whether it is a simple query or a complex topic, our team is dedicated to helping you.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information

Yes, you can connect multiple accounts, including savings, checking, and credit cards, for real-time tracking of all your finances in one place.

While some features may work offline, such as viewing past transactions, most functions—like syncing with accounts—require an internet connection.

Yes you can, many finance apps allow you to monitor investments such as stocks, bonds, and mutual funds, providing insights into portfolio performance.

Automates bill payments, savings contributions, financial reporting, reducing manual effort and the anxiety associated with missed payments.

Our finance apps and software are powerful tools for managing personal or business finances, helping users stay organized, and track financial health