With this tool, you can say goodbye to overspending, stay on track with your savings goals, and say goodbye to financial worries. Get ready for a clearer view of your finances like never before!

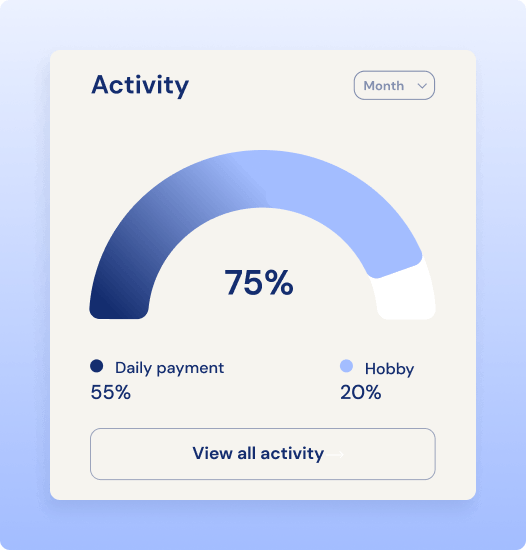

Users can set budget limits for different categories. This tool provides visual insights such as graphs to show how much has been spent.

Users can set budget limits for different categories. This tool provides visual insights such as graphs to show how much has been spent.

Users can set budget limits for different categories. This tool provides visual insights such as graphs to show how much has been spent.

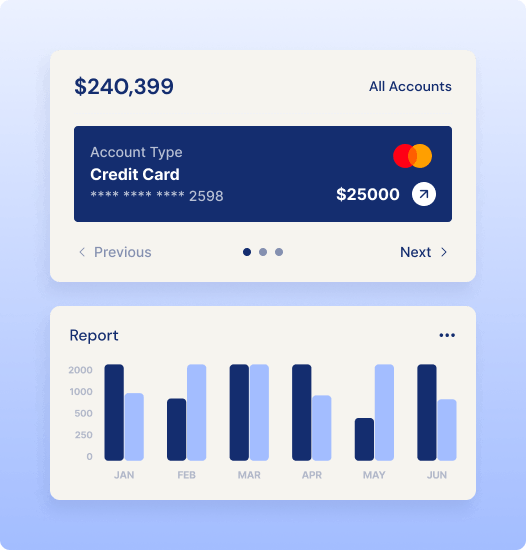

Allows users to record and categorize daily transactions such as income, expenses, bills, and savings.

Provides visual insights like graphs or pie charts to show how much is spent versus the budgeted amount.

For users interested in investing, finance apps often provide tools to track stocks, bonds or mutual funds.

This tool integrate with tax software to help users prepare for tax season, deduct expenses, and file returns.

Tracks upcoming bills, sets reminders for due dates, and enables easy payments via integration with online banking

Provides bank-level encryption to ensure user data and financial information remain safe, MFA and biometric logins.

Plan and monitor loan repayments, credit card balances, and strategies to pay off debt faster.

Set and track your financial goals, such as building an emergency fund or saving for a big purchase or saving for future.

Access detailed reports and visualizations to understand your financial health and trends for real-time syncing.

This feature ensures you can easily stay on top of your finances by consolidating all updates into a single dashboard.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.

Yes, this finance apps use bank-level encryption, multi-factor authentication, and other security measures to protect your sensitive information.